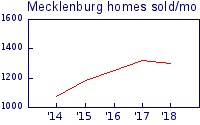

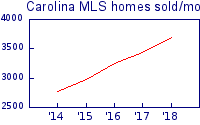

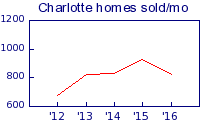

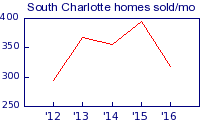

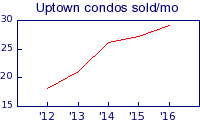

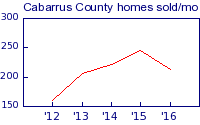

Have you noticed fewer serious buyers roaming the streets? So have we, in the data.

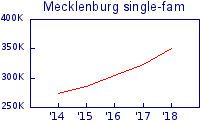

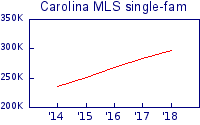

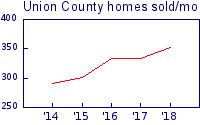

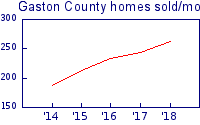

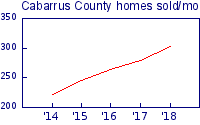

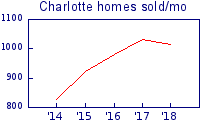

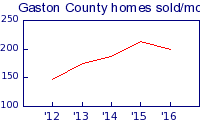

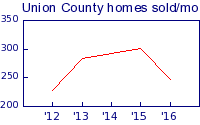

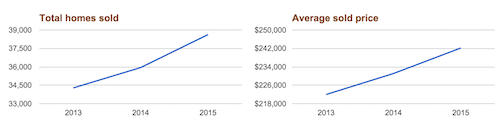

As you can see, the customary drop in sales we see from August-October is noticeably larger this year and the number of homes on the market is higher than it’s been since 2015.

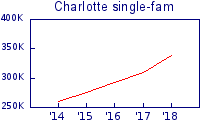

This isn’t panic time — inventory is still low. That said, the days of “put a $500k house on the market & watch it sell in 2 days” are probably coming to an end. The public is often behind on the trends and your Sellers might not realize what’s going on (apart from their homes sitting longer than they expected).

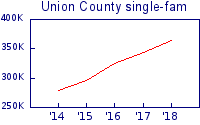

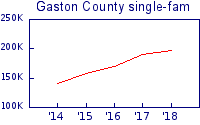

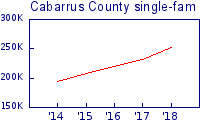

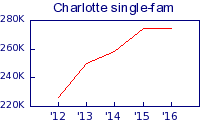

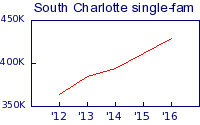

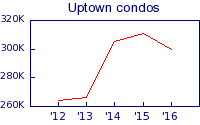

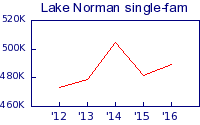

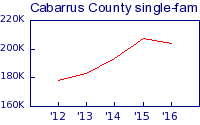

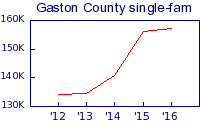

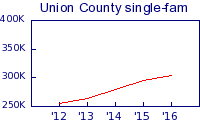

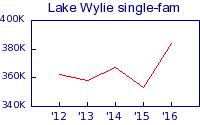

So we’d suggest you compile data (like you see here) on what’s going on. The lack of buyers now means the data you see in the coming months will show an even more stark contract from previous years.

This page updates daily — bookmark it and feel free to download the charts anytime: Market Trend charts.