I’ve got good news and bad news… what do you want first?

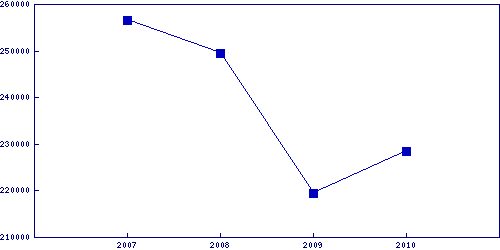

Okay, the good news. Compared to other hard-hit areas of the country, Charlotte has not seen prices go down very much. The average single-family home sold in Mecklenburg County so far in 2010 went for $228k. This represents only about a 10% drop from 2007 (when the average house went for $256k), or an average of 3.33% per year. Not only that, but prices in 2010 are higher than 2009, when the average house sold was $219k (a 4% gain!). Compare that to some parts of Florida, for example, which have seen drops of 30% or more since the peak.

Here is a chart:

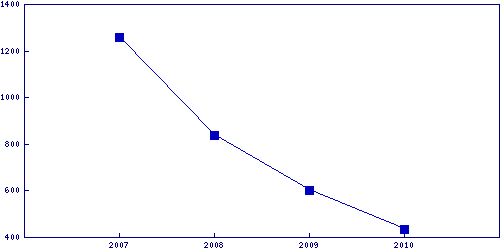

Unfortunately, there is a down side : activity. In 2007, an average of 1,260 houses sold each month in Mecklenburg. By 2009, only about 600 houses sold per month and thus far in 2010 we are averaging under 450 houses sold per month.

Here’s a chart tracking monthly sales since 2007:

Consider that for a moment … a 64% drop in monthly sales since 2007! It’s staggering! Given current absorption, we have almost 4 years of inventory on the market.

So what does all of this mean?

It might be logical to conclude that Charlotte’s home prices have to drop before we’ll see a lot of activity again. But if that were true, why have we seen 4% higher prices in homes sold in 2010? It’s a mixed bag. On one hand, because there never was a big “spike” in Charlotte, it’s reasonable to conclude that the market was not that overvalued, even at the peak in 2007. But on the other hand, where are the buyers?

Like many things these days, it might very well come back to the banks and current lending policies. Anyone intending to purchase a property as anything other than a primary residence has a very difficult time getting a mortgage, regardless of credit score or income. This removes a big chunk of would-be buyers, and is keeping inventory high. On top of that, “move-up” buyers who own a home cannot typically buy another house until they sell their current one. And not only are first-time home buyers more timid than usual these days, but they, too, are dealing with a tight credit market. They need a big down payment and with the media hysteria, many are holding out for a “deal.” But since prices, on average, haven’t dropped much in Charlotte, this means a lot of low-balling, and sellers having to face the choice of being stuck with their house, or having to bring money to closing.

It boils down to confidence. When banks are more confident in the recovery, (hopefully) their lending policies will become a bit more friendly to investors, who are a key element in a healthy real estate market. But also, home buyers need to be confident that their job is not in jeopardy and the value of their newly-purchased home is not going to plummet.

In the end, Charlotte is very lucky to not be looking at the massive drops in value that so many other areas of the nation are seeing. It’s very much a “choose your poison” proposition… would you rather have stable prices with low activity, or much lower prices with more activity? Hopefully as the recovery continues, Charlotte-area REALTORS won’t have to make that choice.