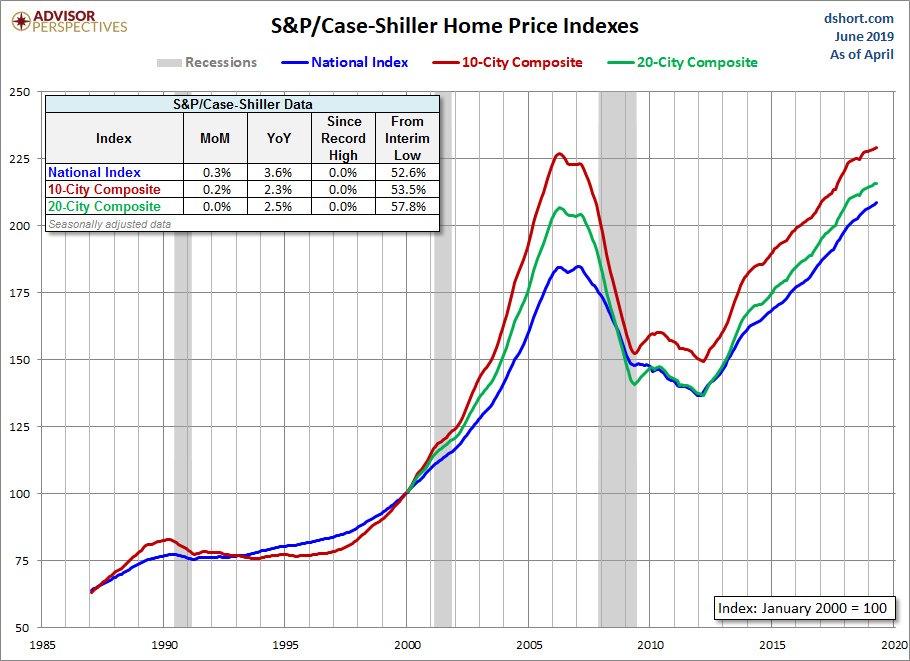

The economic crash of 2008 understandably created a lot of jittery people in the real estate industry. And since about 2011, we’ve seen a lot of price appreciation, so some folks are starting to worry that we’re in for another big drop.

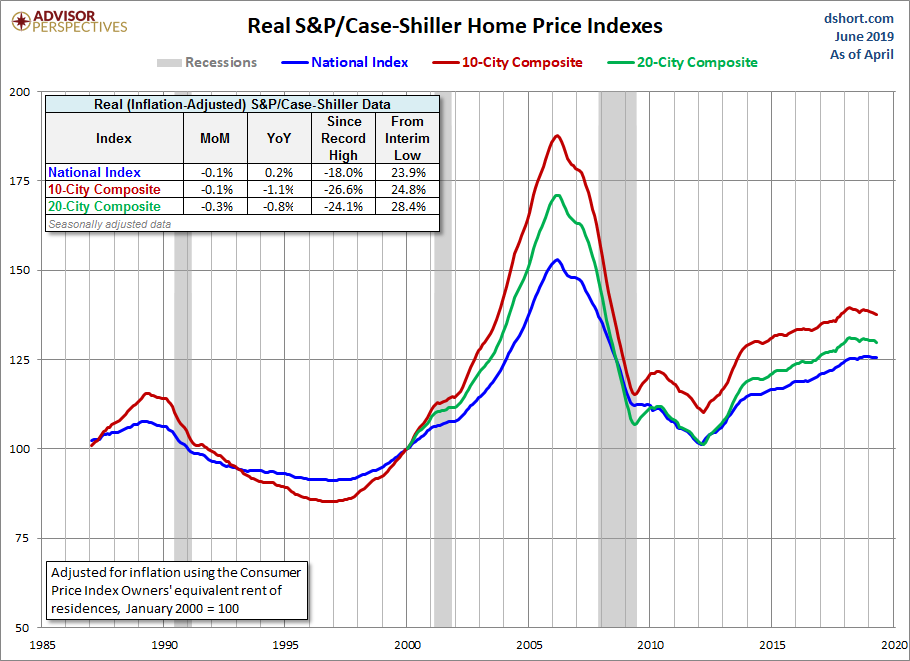

But let’s take a step back and look more closely at these numbers. When you adjust them for inflation, they tell a different story.

Now let’s look at it year-over-year:

Feeling better yet? In the run-up prior to the 2008 crash, we saw year-over-year increases over 15%! This time, the highest it got was just over 10% and that was at the beginning of the recovery.

Add that loan profiles are far, FAR healthier than they were in the early 00s, and it gets much harder to fear this market.

To be clear — the price increases we’ve seen due to low inventory will certainly slow a bit, and maybe even turn the other direction, which is a normal market correction. But we’re not in line for any sort of calamity like we saw a decade ago.

Charts from loganmohtashami.com