If you’re an existing client of ours, you get this neat absorption tool, for free… check it out!

End-of-September Carolina MLS market update

Just under 1,300 homes sold in Carolina MLS in September. That’s just over half as many as the 2,550 that sold in June, and about 350 (~20%) fewer than in August. For a little statistical fun (or just if you are in too good a mood today), compare to June, 2007, when a whopping 4,200 homes sold in Carolina MLS! Crazy!

But as we’ve pointed out before, while our activity has markedly dropped over the past couple of years, prices have been relatively stable.

September saw a bit of a dip in price, with the average home going for about $206k, about 6% less than in August. But consider at the market peak in 2007, the average home sold only went for about $230k, so even a bad September is still only about 10% off the peak. And overall, 2010 is still better than 2009 in both activity AND price.

So as we’ve pointed out for several months, 2009 really, REALLY looks like a bottom! If this trend holds, hopefully more of those jittery buyers will come out of the woodwork next spring.

Posted via email from Charlotte real estate technology, IDX, market data

2007 vs. 2010: what has changed?

In terms of home prices and activity, 2007 represented the peak in metro Charlotte: about 1,250 homes sold per month in Mecklenburg that year, at an average price of $257k. This year, about 725 houses a month are selling in Mecklenburg, at an average price of $241k. The prices have only dropped about 6% since the peak, but activity is down about 40%.

These numbers probably don’t look too unfamiliar, so we decided to delve deeper. Looking at the sold properties from both 2007 and 2010, what trends can we identify?

The first one, you could probably guess. In 2007, the “under $200k” price bracket represented 58% of the homes sold in Mecklenburg. The $200-500k range was 35% of homes sold, and the last 7% was homes over $500k.

“Sold” price ranges: 2007

In 2010, interestingly, one of these percentages is identical : the over $500k range! But homes under $200k are up to 63% of homes sold, and that 5% gain came entirely from the $200k-$500k range, which is down to 30% of homes sold.

“Sold” price ranges: 2010

Other than that 5% “swap” between price ranges, what else is different? Frankly, not much! We examined the MLS areas, and found the sales patterns were almost exactly the same. Area 1 had the most sales in both 2007 and 2010, representing 19% of homes sold in Mecklenburg, followed by Areas 5, 2, 9, 4, and 3. The percentages stayed virtually the same, with a few of the areas moving by at most 1%. Areas 5 and 7 were down by 1%, and Areas 2 and 3 were up by 1%. But otherwise, everything was almost identical.

| Area | 2007 | 2010 |

|---|---|---|

| 1 | 19% | 19% |

| 5 | 16% | 15% |

| 2 | 13% | 14% |

| 9 | 10% | 10% |

| 4 | 9% | 9% |

| 3 | 8% | 9% |

| 7 | 8% | 7% |

| 8 | 7% | 8% |

| 6 | 5% | 5% |

So what’s to conclude? Honestly, these numbers show that Charlotte is experiencing many of the same trends as other areas, but unlike some of the hard-hit areas, prices are very stable here. For prices to have only dropped 6% from the peak is almost remarkable in these times. If you have any REALTOR friends in Florida or Nevada, ask them how low prices are now compared to the peak, and you will hear percentages like 20 or 30%.

Until next time… Happy Labor Day!

Posted via email from Charlotte real estate technology, IDX, market data

Almost end-of-summer Carolina MLS market report

Posted via email from Charlotte real estate technology, IDX, market data

The market within the market: price ranges

Posted via email from Charlotte real estate technology, IDX, market data

A tale of two lakes: LKN/LKW market stats

Posted via email from Charlotte real estate technology, IDX, market data

Assessing June market data & watching for ‘move-up’ buyers

As expected, activity was up in June : there were about 11% more closings than there were in May. But perhaps surprisingly, the average price of homes sold in June was also up : by about 8%! Here’s a chart (note, you can ignore the July data, which is still very incomplete) :

Posted via email from Charlotte real estate technology, IDX, market data

Don’t be scared of the big, bad anchorman… home sales not so bad in Charlotte area

The news came out yesterday : home sales from April to May plummeted after the expiration of the home buyer tax credit. The numbers were as bad as they’ve been since the Commerce Department started tracking this data in 1963.

I probably had 5 or 6 friends give me this news in one way or another, and then the talking heads on TV dissected it ad nauseam. So, naturally I had to see what the story is locally in the Charlotte area.

Sales dropped from April to May, but only about 5%. However, over that same period, the average price of those sales rose by about 4%! Note that the graph we’re attaching shows June data, but it is still incomplete (the data is through June 23).

We’ve been hearing bad news in our business for about 2 years now, but it’s critical to remind your clients that market stats are a local thing. Things might be awful in one area of the country, but that doesn’t mean they’re as bad here in Charlotte. The fact is, we never saw a value “spike” here like they saw in many areas (such as Florida and California) and so prices have been rather stable, even in the face of a recession.

So, get on the horn and reassure your clients, and feel free to use our graphs if they’ll help.

Posted via email from Charlotte real estate technology, IDX, market data

Content is king: spread your knowledge, drive traffic

When we started in this business in 2005, getting Internet leads was much easier by comparison because there just wasn’t as much competition out there. But now, virtually every real estate agent on planet Earth has at least 1 website, and are vying for the same buyers you are. Here are some tips to stay ahead of the crowd!

1) Create searches and post them!

Got a few minutes of down time? Go to your IDX, do a search, and copy & paste the URL into Facebook/Twitter/your blog, etc.

Example: Did you know there are over 100 3BR/2BA houses under $250k that are within 3 miles of uptown?

Be creative!

Here are some options for homes under $200k that are in the sought-after Myers Park school district!

Get inside the mind of your potential buyers and post the searches you think might interest them.

2) Give the people what they want : stats!

Our IDX is loaded with great data. Let’s say you have a listing and you want to show that it’s a great deal. Post the “Market Check” page with all the nearby solds.

Or, if you’ve got our “Neighborhood Analyzer,” you can give great information about a neighborhood :

In Providence Plantation, sellers have taken about 3.5% less than list price in the past 3 months.

Or post a graph to *show* them:

Take advantage of the data! This is good stuff that buyers and sellers really want to know. Think of unique ways to present it and post it to your various sources : Twitter, Facebook, etc.

3) More is better

Our clients often ask us : how often should I blog, or tweet, or update Facebook? The answer : more is better. If you sell Lake Wylie, for example, the more good stuff you post about it, the more likely it is to be found. Buyers do a lot of searching online before they choose a Realtor, and if you’re the one posting the good stats and providing the best information, you have a better shot at getting that lead.

Mecklenburg County activity report (post-tax credit)

The infamous tax credit expired on April 30, and now the question is how many closings will we see, and what “move up” buyers will do after they sell their homes to buyers who took advantage of the tax credit.

Without further adieu…

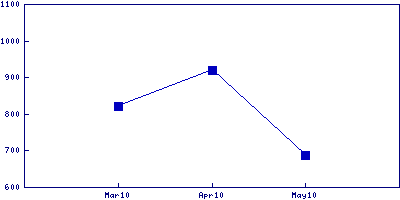

Houses+condos sold per month in Mecklenburg County

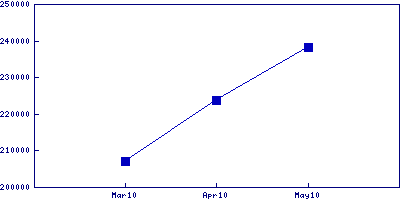

Average price of houses+condos sold in Mecklenburg County

As you can see, it’s a mixed bag. As of now (June 1, 2010), some of the sales from May might not have been reported yet, so it’s possible that number of 688 houses+condos sold in May will go up. But given how “thorough” most lenders are these days, it’s not entirely surprising that people who went under contract in late April might not have closed yet.

But the increase in average price certainly shows that values in the area are quite stable. As we’ve written before, Charlotte hasn’t seen the massive drops in value that other areas have seen, but activity remains low.

Certainly, with more “tax credit” closings to occur in the next 30 days, there is hope that some “move-up” buyers will start hitting the market in the next quarter. Fingers crossed!